The following is an AMA on SportTechieHQ with Vasu Kulkarni, founder of Krossover.

About SportTechieHQ: SportTechieHQ is a Slack community for sports tech experts, professionals, and thought leaders in the industry. It’s a place to find a constant flow of motivation, discover new ideas, and learn new ways to improve, all at the intersection of sports and technology. To learn more about SportTechieHQ, join our community, or attend any future AMAs, visit:www.sporttechiehq.com

About Vasu Kulkarni: Vasu founded Krossover, a sports video analytics company backin 2009 after graduating from Penn. He is also a managing partner at Courtside Ventures, a $35M early stage venture fund investing in sports tech. His work has been featured in a number of different publications and outlets. In 2010, he was honored as a finalist for Bloomberg Business’s young entrepreneur of the year award. Vasu’s knowledge of the sports tech industry, along with his fiery passion for sports, set the stage for an awesome AMA!

As we began our AMA, Vasu’s character immediately shines through.

“Here’s an hour of your life you’re never going to get back folks”- Vasu

His wit and undeniable sense of humor is almost synonymous with the successes he has seen in the sports industry.

Join @sporttechiehq tonight for a live chat AMA with, well, unfortunately, me. https://t.co/gTpi8pDjl5

— Vasu Kulkarni (@Vasu) March 15, 2016

… that and his unwavering love for basketball . Being that its March, he probably won’t even read this. By the time he makes it out the other side of his basketball filled, sugar induced March Madness hibernation, this AMA will be far from relevant.

. Being that its March, he probably won’t even read this. By the time he makes it out the other side of his basketball filled, sugar induced March Madness hibernation, this AMA will be far from relevant.

Just ordered a pizza, a root beer, a box of cupcakes and a sundae. Got a long night of hoops ahead of me. Need sugar. #MarchMadness

— Vasu Kulkarni (@Vasu) March 19, 2016

I would caution you to not sleep on this guy though, I promise you its not all cupcakes and beer. I wouldn’t be surprised if between every free throw, every bite of pizza, and during every commercial he is either skimming through a pitch deck or quickly handling one of the numerous other tasks involved with running a company and managing a VC firm. I don’t know how else you could manage copious amounts of junk food, March Madness, a startup, and a venture fund all simultaneously. Oh and by the way, the company is Krossover which has 80+ employees and works with over 10k teams across the world. And the VC firm is Courtside Ventures which is an early stage venture firm that manages a fund of $35M. Meanwhile, I’m over here binge watching the new season of House of Cards and struggling to figure out when I should order seamless or get up and go to the bathroom.

“I work 2 part time 80 hour jobs… I think the key is to be able to focus for short periods of time on whatever task is at hand. I also work insanely long hours, stopped drinking and haven’t been to a club in years, although Yoder and I did crash Draymond Green’s birthday 2 weeks ago.” — Vasu

“I am curious the time split between krossover and the fund? I am sure there are lots of overlaps?”-Me

“plenty of overlaps. Companies that come in for funding end up being potential partners, and partners end up becoming potential funding targets” — Vasu

The overlap between the two companies makes for a pretty sweet set up. And although the hours are long, he seems to manage all of it like a champ. He has surrounded himself with some pretty successful people to learn from too.

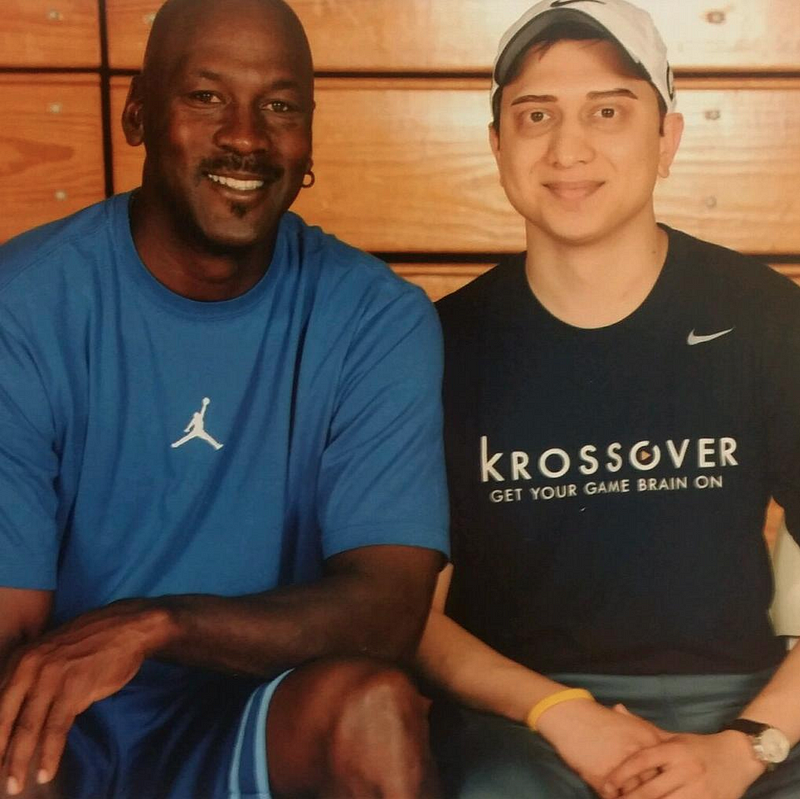

… Oh no big deal, just Michael Jordan and Vasu casually taking a picture together as if they were merely sitting beside each other at a rec league basketball game getting ready to watch the tip off. When randomly the team mom/social media coordinator passes by and asks them to scootch together for a quick photo to post on Facebook.

(Please caption this photo and tweet it to me)

Also, that Draymond Green birthday party he casually crashed with “Yoder” is James Yoder, CEO of Chat Sports. Not bad company by any means.

*(Oh, reminds me, we held our AMA with James the other night. Stay tuned for more info on that.)*

Amidst the serious questions during our AMA with Vasu, James stopped by to stir things up a bit. Obviously knowing which buttons to push.

“If the NBA offered you $1B to acquire Krossover, but it means you can never watch Steph Curry again…would you do it .”— James Yoder

Unaware of the personal connection between James and Vasu, the community got a kick out of the whole Stephen thing.

.@Vasu thanks so much for speaking with @SportTechieHQ tonight! I learned a ton about VC, startups, and your love for @StephenCurry30

— Katie Van Veghel (@Katie_VanVeghel) March 16, 2016

“As for Yoder’s question — No, I would not sell my company for a billion if I could no longer watch steph curry. Steph is the greatest thing to happen to basketball since MJ” — Vasu

“Serious question… Non Curry related: What are the key metics Krossover has focused on when approaching investors and how had that metric changed from Seed to A and beyond.” — James Yoder

“Yeah, those things definitely change from round to round. Early on, it was basically my face that people were betting on, and I’m not exactly the best looking bloke in the room

Soon after that, I’d say it was being able to prove that SOMEBODY was willing to pay for this product, which we did by getting our first couple hundred customers

That just because 500 people bought it…. it meant that i could eventually get 50,000 to buy it too” — Vasu

Courtside Ventures

Here’s where it gets good! Tell me where to find better advice than this and I will give you… (nickels? I think thats the expression? something about nickels right? ). Anyway, if you are looking to connect with the venture community. Which you should be looking to do…

). Anyway, if you are looking to connect with the venture community. Which you should be looking to do…

“frankly, I recommend that every entrepreneur have some sort of deep tie to the VC community helps you get to see a lot of stuff that’s happening in your space that you wouldn’t otherwise get access to” — Vasu

… What better way to connect with the community then to actually BE “the community?” As an entrepreneur himself, if he weren’t the managing partner of Courtside, he would be coming to himself to raise money for Krossover. Think about that for a minute. I know, super meta . In the dog eat dog world of fundraising, being on both sides of the table gives you a rather unique perspective…

. In the dog eat dog world of fundraising, being on both sides of the table gives you a rather unique perspective…

“if you haven’t had a chance to really dig in operationally to running a company at 2 people, at 20, and then at 200, you really don’t know what it’s like to walk in an entrepreneur’s shoes and so I hope I can bring that empathy to the process” — Vasu

So here we go, the stage was set…

“What’s one misconception that most people have about VCs?” — Igli Panariti

… Get it Vasu! Tell us why you are different from all of those other heartless, dream crushing VC’s out there.

Igli set him up for a homer…

“I’d say in my short time, I can’t tell you how many deals have come across my desk. I’ve been at this for 4 months now, I’ve probably seen AT LEAST 500+ deals, and people somewhat filter what they send me.

so when people think we’re saying no because they don’t have a good business or because we just don’t want to do a deal, you gotta remember a few things

1. We need you more than you need us

VCs don’t make money if we don’t invest

so we REALLY REALLY want to invest money

we’re not trying to hoard that cash for something else down the road hoping that the next uber comes around

2. The economics that we are playing with as a VC don’t necessarily align with a founder or an angel investor

Let’s look at my $35M fund for example

I make $0 until I have returned all $35M of that money to my investors

I have about 25–30 bets that I can place to make this happen

let’s say I’m investing $1M at a $10M valuation on a company

I own 10% of the company, and over the course of a few more rounds, let’s just assume I put more money in and maintain my 10% ownership

let’s say the company sells for $30M

great outcome for founders

I make back $3M

that’s not even 10% of my fund, and I am assuming that 33% of my companies will fail, 33% will maybe return some money or even money ….

which means that I really need to believe with all my heart that you’re actually going to sell this thing for $300M and if I don’t, no matter how much I love you or your business, I have to say no

3. VCs constantly say “you’re too early”

that’s really just code for “I don’t think this business is going to return my fund”

I bite my tongue every time I want to say that to an entrepreneur because there is nothing I hate more

the truth is, we REALLY want to be early

that’s the only way we can place smaller bets and somehow make the economics work

So if you hear that, it means they don’t believe in the model, or they don’t believe that it can be big enough

4. VC’s know what’s right: Trust me on this, we don’t really know shit.

early stage investing is throwing a dart at a wall and praying

although we need to filter down as many companies as we possibly can before we throw that dart to try and better our chances of success

Phew!” — Vasu

… and he knocked it out the park.

… and he knocked it out the park.

“I think I bring a very unique viewpoint to venture by possibly being the only VC still running an active startup, which is growing. So I really hope I can try and do VC “right”, whatever the hell that means.” – Vasu

Krossover

The “startup, which is growing”…

Despite the fact that Krossover serves over 10k teams from around the world, they are still the underdog in this market. According to Hudl, they own quite a chunk of the sports video analytics market. Boasting these numbers on their homepage; 125,434 amateur teams, 2,055 college programs, and 1,087 professional teams.

. So Hudl isn’t going anywhere for now.Krossover is sure as hell ready to give them a run for there money though. As confident as Hudl is in their numbers, Vasu and the Krossover team are equally as confident in their growing stake in this expanding market. They don’t shy away from the “Hudl question” either….

. So Hudl isn’t going anywhere for now.Krossover is sure as hell ready to give them a run for there money though. As confident as Hudl is in their numbers, Vasu and the Krossover team are equally as confident in their growing stake in this expanding market. They don’t shy away from the “Hudl question” either….

Wonder how we compare to Hudl for #football coaches? Check out this chart that lays it out. https://t.co/5g1pf64Obr pic.twitter.com/wl33AEAl8r

— Krossover (@Krossovr) March 19, 2016

“They own football, we own hoops and lax. We fight over everything else. They are the 800 pound gorilla, and we’re the feisty startup that is coming for them. The market is big enough for 2 players, which is what it has come down to now. It’s a 2 horse race and I’m okay with that.” — Vasu

So whats the consensus then? Krossover vs. Hudl. Will this be the classic underdog cinderella story? No term more fitting for the scrappy, basketball crazed, fund wielding founder. Or will we anxiously watch on as Hudl sweeps its competition in a American Pharoah-esque race to the finish. I guess we will have to wait and find out. One thing is for sure though, it will be quite the race to see…

“We’ll see what happens down the road, but I don’t think either of us is going anywhere” -Vasu

“The best way to predict the future is to create it” –Abraham Lincoln

Don’t sit on the sideline while we continue to shape the future of sports.